Cryptocurrency has revolutionized the financial world, offering new opportunities for investors and disrupting traditional markets. However, with its meteoric rise, the crypto market has been characterized by extreme volatility, putting investors on high alert. While many are drawn to the potential for high returns, the unpredictable nature of cryptocurrencies has led to significant risks, forcing both seasoned and new investors to reconsider their strategies.

What Is Crypto Volatility?

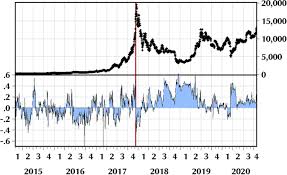

Crypto volatility refers to the rapid and significant price fluctuations that cryptocurrencies like Bitcoin, Ethereum, and others experience. Unlike traditional stocks or bonds, which tend to have more stable prices, cryptocurrencies are notoriously volatile, sometimes swinging in value by double-digit percentages within a matter of hours.

This volatility is driven by several factors, including market speculation, regulatory changes, technological developments, and broader economic conditions. While such price swings can present opportunities for high profits, they also carry substantial risk.

Why Is Crypto Volatility So Extreme?

- Market Speculation

Cryptocurrency markets are largely driven by speculation. Since these digital assets are not backed by any physical goods or government entities, their value is often based on what investors are willing to pay for them at any given time. This speculative nature can lead to sharp price movements as news or trends quickly sway market sentiment.

For example, if a well-known entrepreneur tweets positively about Bitcoin, the price can soar. On the other hand, a negative news report, regulatory concerns, or market rumors can send prices tumbling. This rapid shift in investor sentiment contributes to the high volatility of cryptocurrencies.

- Lack of Regulation

Unlike traditional financial markets, the cryptocurrency market is largely unregulated. While some countries have started introducing regulations for digital currencies, there is still a lack of global consensus on how they should be handled. This regulatory uncertainty can lead to sudden price drops when governments take action—such as banning crypto transactions or imposing new taxes—or when regulators release statements that cause concern.

The absence of regulation also makes the crypto market more susceptible to market manipulation. Whales, or individuals with large amounts of cryptocurrency, can significantly impact prices with their trading activity, further contributing to volatility.

- Low Market Liquidity

Crypto markets, while growing rapidly, are still relatively young and less liquid compared to traditional stock or bond markets. This means that it takes less capital to move the price of a cryptocurrency significantly. When a large investor buys or sells a substantial amount of a crypto asset, it can cause massive price fluctuations. The lower the liquidity, the higher the volatility.

- Technological and Security Risks

Another factor contributing to crypto volatility is the technology behind digital currencies. Crypto markets can be affected by technical developments, such as software updates, security breaches, or network congestion. For instance, the sudden crash of a major exchange or a vulnerability in the underlying blockchain technology can create uncertainty in the market, leading to steep price drops.

- Macro-Economic Events

The broader economy also plays a role in crypto volatility. Events such as changes in interest rates, inflation concerns, and stock market crashes can influence the price of cryptocurrencies. Since many investors view digital currencies as an alternative to traditional assets, they may react to global economic shifts by buying or selling in large quantities, adding to the volatility.

The Risks of Crypto Volatility for Investors

- Potential for Significant Losses

The biggest risk for investors in a volatile market is the potential for significant financial losses. While cryptocurrency can offer the possibility of high returns, those same price swings can quickly reverse, leading to rapid declines in value. Investors who buy into a cryptocurrency during a price surge may find themselves facing steep losses if the market corrects suddenly.

- Emotional Decision-Making

Crypto volatility can lead to emotional decision-making, as investors may panic when prices drop or become overly optimistic during price surges. This emotional reaction can lead to buying high and selling low, which is a common mistake that many investors make. The fear of missing out (FOMO) and fear of losing (FOL) can cause individuals to make rash decisions, which can be detrimental to their portfolios in the long term.

- Unpredictability and Market Timing

The unpredictable nature of crypto markets makes it difficult to time the market successfully. With such erratic price fluctuations, even experienced investors struggle to predict short-term movements accurately. Timing the purchase or sale of cryptocurrency is a high-risk endeavor, and many investors fail to make profits due to the difficulty of predicting when to enter or exit the market.

- Security Concerns

While cryptocurrencies offer the promise of decentralized financial freedom, they are not immune to hacking, fraud, and theft. High volatility can attract malicious actors looking to exploit weaknesses in crypto exchanges or wallets. Investors who do not take proper security precautions may find themselves at risk of losing their investments in the event of a cyberattack.

How Can Investors Protect Themselves?

- Diversification

One of the most effective ways to mitigate risk in a volatile market is diversification. Rather than putting all funds into one cryptocurrency, investors can spread their investments across different assets, including traditional stocks, bonds, and other alternative investments. By diversifying, investors can reduce the impact of a potential loss in the crypto market.

- Long-Term Perspective

A long-term investment strategy can help weather short-term volatility. Investors who view cryptocurrency as part of a broader, long-term portfolio are less likely to be swayed by daily price swings. Focusing on the potential of digital currencies over the next few years or decades—rather than trying to make a quick profit—can help investors stay calm in turbulent times.

- Risk Management Strategies

Implementing risk management strategies, such as setting stop-loss orders or investing only what one can afford to lose, can help limit the potential for significant losses. It’s also wise to avoid using leverage, as borrowing to invest in cryptocurrencies increases the risk of losing more money.

- Stay Informed

Staying up to date on crypto market trends, news, and technological developments is essential. Understanding the factors driving volatility and recognizing market patterns can help investors make more informed decisions and better navigate the ups and downs of the market.

Conclusion

The volatility of cryptocurrency markets is a double-edged sword. While the potential for high returns is enticing, the risk of significant losses is a constant threat. Investors need to carefully consider the risks before diving into the crypto world and develop strategies to manage those risks effectively. Whether through diversification, long-term investing, or risk management, being prepared for the ups and downs of the crypto market can help investors navigate this high-stakes landscape.

Jackpots Await! Try Our Slot Machines and Claim Your Winnings on kkclub.pk